Copy Product Tax Exemption

There are many classifications of products that can be designated as Tax Exempt.

It is important that you define a product type or use a product type to designate the ones applicable to your company.

Below are a number of possibilities.

Newsletters

Standard A – 3rd Class Mail

Hand Delivery – 3rd Party Service

Single Copy Sales to non-subscribers

Reprints of Articles

Sales of disks w/ reproduction rights (TPP)

Electronically Sent

Books

Book Updates

Video Tapes

Microfilm

Advertising Space

Fax Services

Seminars

Shipping

Handling

Internet Periodical Subscriptions

Internet Advertising

Free Distribution of Directory

Information Services

Internet Training

Digital Books

Bundling

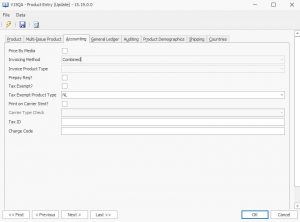

Once you have defined your tax exempt products, you will need to assign your Tax Exempt Product Type using the Product Entry Update window (Setup > Product Related > Product Inquiry)

For example, if News Letters are tax exempt in one or more states, then you would create a Tax Exempt Product Type of “NL” and apply that to any product considered a Newsletter.

Next, using one of your tax exempt NL products, you will need to set up Product Tax Exempt Records for each state for the designated Product Type. (Setup > Accounting/Tax > Product Tax Exempt)

You will then need to copy the tax exempt records for each product that have the same Tax Exempt Product Type using the program Copy Product Tax Exempt Records.

Once you enter the Tax Exempt Product Type, the program will find the first product with the same Tax Exempt Product Type and will copy all the Product Tax Exempt Records from that product code to ALL product codes with the same Tax Exempt Product Type.

Running Copy Product Tax Exempt Reports

Enter the Tax Exempt Product Type and State that you set up in Product Tax Exempt table to copy all the tax exempt records .

The program will then copy all the Product Tax Exempt Records from that state to the new state for the Tax Exempt Product Type entered.

Deletions

If a state revokes the tax exempt status for a particular Product Tax Type, the Product Tax Exempt Records need to be deleted.

To delete a Product Tax Exempt Record for a state for a particular Tax Exempt:

Enter the Tax Product Type to delete and the Ctry or State and ok = yes.

The program will delete all the Product Tax Exempt Records for that Tax Product Type for that state .