The Multi-Currency module is for those Multipub users who want to accept and bill subscribers in their native currency.

How it Works

Currencies are defined with exchange rates. Orders are entered with the desired currency.

When the order is posted

- The exchange rate, at the time of posting, is posted to the order (ORD).

- Foreign transactions are created in the foreign currency (FOPN).

- Native currency transactions are created using the exchange rate on the order (OPN).

- When additional transactions are entered and posted, foreign transactions are created and native currency transactions are created using the exchange rate on the order.

- When a payment is made in the foreign currency, the exchange rate at the time payment was posted is posted to the foreign transaction.

The GAIN LOSS report details the gain or loss due to the change in the exchange rate. The DEPOSIT report lists both the native currency and foreign currency.

Setup Required

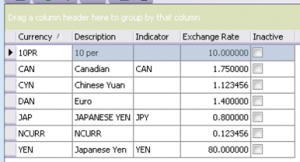

- Establish currencies to be used within Multipub:

Each currency must be given a unique code.

The exchange rate can be updated as dictated by the user needs. The exchange rate should be in U.S. dollars.

The indicator is what will be printed on the invoice.

2. Establish new rate codes and assign Currency Codes to be used within Multipub:

For each currency that is to be used (other than ‘native’ currency), a rate code must be established for each different price. The rate code will be flagged with the appropriate currency code. This currency code tells the system what exchange rate to use so sales can be calculated in both the native currency and foreign currency.

For example, assume the following rate codes were previously established:

IND = Individual Sales

AGN = Agency Sales

FOR = Foreign Sales

STU = Student Sales

Payment will be accepted from subscribers in either U.S. Dollars or Canadian dollars. To use Multi-Currency set up the following currency code and additional rate codes:

Currency Code: ‘CAN’

Additional Rate Codes:

CAN = Canadian Individual Sales

CAGN = Canadian Agency Sales

CSTU = Canadian Student Sales

Each of these 3 rate codes would have the prices entered as Canadian amounts, and have the currency code of ‘CAN’ attached to them. If $1.00 US is equivalent to .80 cents Canadian, then a rate code is set-up that is $50.00 US as $60.00 Canadian with a term of 12.

The Suspension/Cancellation minimum amounts need to be in foreign currency.amount.

3. Credit Card Processing for Foreign Currency

Multi-Currency users are required to have a Merchant ID File for each merchant used to process credit cards. If the merchant requires that all transactions should be in native currency then the user should answer yes to the question “Convert to Native Currency?” All transactions exported from the system will be converted to the native currency based on the exchange rate established at the time the order was placed. For cancellations this process is the same. When canceling an order the exchange rate used will be the exchange rate in place at the time the order was created. Further instructions on this item can be found under the Setup documentation.

4. Establish type checks for specific currency codes

A type check should be established for each foreign currency with appropriate GL account numbers for cash as well as credit cards. For example, there is currently a payment type of ‘VISA’ and it is decided to accept credit card payments in a non-native currency, therefore a payment type of ‘VCAN’ with the currency code of ‘CAN’ on it will need to be established. The Merchant ID field must be established under Multi-Pub Admin/Setup/Merchant ID with the Convert to Native Currency question answered no if the merchant would like the payment amount to be in the amount of the foreign currency.

5. Establish Delivery Codes for Foreign Currency

If the user has delivery codes setup for their products then delivery codes for foreign currency must also be established. This will ensure that amounts invoiced will reflect and print in the foreign currency amount. However, the monetary value fields in this field do not calculate off of the exchange rate and users are responsible for increasing or decreasing this amount as they deem necessary.

Data Entry

Once the currency code, rate codes, and type checks are set up, the rate codes are used in order entry to identify those orders which are being maintained in a foreign currency. The sales amounts will be displayed and stored based on the amounts on the rate code. Based on the rate code, the currency code and the exchange rate at the time the order was entered will also be stored on the order.

The Transaction Edit Report, Posting Journal and Exception Report will include the currency in which an order was established or paid. When the transaction is posted the exchange rate from the order is used to convert the sales amounts to native currency.

Foreign currency rules:

- Payments must be made in the same currency as the order when placed. Invoices and payments will be made at the rate of exchange that was in effect when the order was posted. Fluctuations in exchange rate will not affect exiting orders.

- All line items must be in the same currency.

- On posted orders the rate code on an order can only be changed to a rate code with the same foreign currency.

- Discounts will be figured and deducted based on the foreign currency. Therefore if the subscriber gets a 10% discount and the order is placed for 54 pesos the amount due will be 54 – 5.4 = 48.6 pesos.

Inquiry

In inquiry the amounts due and paid will be listed in the foreign currency. If the user looks further into the particular transaction it is noted that the currency in which the order was paid or made is listed as well.

Queries

Queries on order will be output with mixed currency.

Invoices and Renewal Campaigns

Invoices and renewal statements will be in the foreign currency of the order.

Note for renewals – it is possible for the user to renew a foreign rate code to a native rate code.

Reports

When the transaction is posted the exchange rate from the order is used to convert the sales amounts to native currency depending on the files being updated. A synopsis of reports affected are listed below:

Report Effect – all in native currency except as noted

Deferred Revenue

Aging Reports

ORD Activity

Transaction Activity

Transaction Edit List Will report in mixed currency

Transaction Posting Jrnl Will report in mixed currency

Circ Analysis Reports

Aged Cash Receipts Rpt

Deferred Revenue Bal Rpt

Earned Income Reports

Deposit Report Both currencies

Month-End Balancing Rpt

Invoice Effort Analysis Will report in mixed currency

Invoice Report Will report in mixed currency – totals will not be correct if Multi-Currency is active

Invoice Register Will report in mixed currency

Payments by Batch Will report in mixed currency

Sales Tax Reports

Transaction History Rpt

Uninvoiced Report

Unshipped Report Will report in mixed currency

Orders Expiring Report

Inventory by Issue Report

Sales Commission Rpt

Renewal Tracking Proj

Promotion Analysis Rpts